Last modified: Wednesday, July 13, 2011

IURTC executes licensing agreement with professor's start-up, Guidewave Consulting

Agreement commercializes research which found correlations between social media and financial market activity

FOR IMMEDIATE RELEASE

July 13, 2011

BLOOMINGTON, Ind. -- The Indiana University Research & Technology Corp. has executed an exclusive licensing agreement with Guidewave Consulting, a start-up company created by a faculty member in the IU Bloomington School of Informatics and Computing.

Johan Bollen

In October, an IU team led by Associate Professor Johan Bollen found a correlation between the value of the Dow Jones Industrial Average and public sentiment as presented on Twitter. The IURTC is licensing patent and software rights to this research.

Guidewave has signed a consulting agreement with Europe's first social-media based hedge fund, Derwent Capital Markets of London.

The agreement being announced today (July 13) includes intellectual property that led to research that received worldwide attention last fall. Bollen and Ph.D. candidate Huina Mao were able to measure the collective public mood derived from millions of tweets to predict the rise and fall of the Dow Jones Industrial Average up to a week in advance with an accuracy approaching 90 percent.

"The neat thing about this technology is that it lends itself to a number of different areas and opportunities and industries that can take advantage of it," said Tony Armstrong, president and chief executive officer of the IURTC.

"What we're doing with Johan is hopefully the first in a number of these kinds of opportunities with faculty in the School of Informatics, to turn the great work that they're doing into commercial opportunities," Armstrong added.

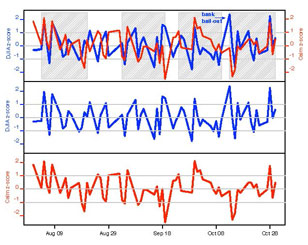

As demonstrated in the release being licensed to Guidewave, a graph of Dow Jones Industrial Average values (center, blue) and tweets identified with a "calm" mood during a time series (bottom, red) running three days prior are overlaid in the top graph to show gray areas of significant overlap.

As it has with some other faculty start-ups, IU has taken a small equity position in Guidewave, which provides further support for the new venture and allows the university to benefit from its future financial success. Bollen said he appreciates that support, which included the university's pursuit of a U.S. patent for his research.

"I was very impressed by IU being very flexible in setting up the terms of this agreement and the speed with which they finalized it and how they responded to the changes in our planning," said Bollen, who previously commercialized research tools he developed at Los Alamos National Laboratory. "They moved rapidly and showed tremendous flexibility and a willingness to take my interests as an IU faculty member to heart."

Bobby Schnabel, dean of the IU School of Informatics, said today's announcement is a good indication of the university's strong support for commercializing information technology research, which he hopes will encourage other faculty.

"I've been impressed that IURTC has worked constructively with Johan to come up with a model that worked well for his case," Schnabel said. "Encouraging entrepreneurship is a priority for our school and is something that we want to help our faculty to do.

"This case really shows a difference between IT research, where interest can be immediate and the time frame for capitalizing can be tight, and bio-medical research, where there's a schedule of tests and approvals which is measured in years," he added. "The IT community can move very quickly."

"We're very excited to be working with Guidewave Consulting and Indiana University to utilize and develop the sentiment analysis technology," added Paul Hawtin, founder and fund manager of Derwent Capital Markets Ltd. "Investors accept that financial markets are driven by greed and fear so it's hugely valuable to monitor and understand global sentiment in real-time."